Some buyers are very fortunate to be able to pay cash when buying investment properties, but it’s not practical for most property investors.

That’s where buy to let mortgages come in; you can still invest in property without having the capital to purchase a property outright.

Actually, buy to let mortgages are how most investors choose to finance investments. The majority of investment property purchases in the UK – around two-thirds are done through a buy-to-let mortgage.

So, if you’re looking at getting a mortgage for property investment, we’ll explain everything you need to know about how buy to let mortgages work.

In this guide, you can learn the basics of how buy-to-let mortgages work and get to grips with how lenders will calculate your affordability.

So, what exactly do you need to know about how Buy-to-Let mortgages work?

Who Can Get a Buy to Let Mortgage?

You’ll need to meet certain criteria before applying for a buy-to-let mortgage. Lenders won’t offer buy to let mortgages to potential property investors if they don’t meet the usual requirements.

- You're looking to invest in houses or flats in the UK

- You have the funds and understand the risks of property investment

- You own your own home, either with an outstanding residential mortgage or outright

- You earn £25,000+ a year

- You have a good credit record and aren't aren't too reliant other borrowings like credit cards

- You'll be under the age of 75 when your mortgage agreenment ends

How Buy-to-Let Mortgages Work

Buy to let mortgages are different to your typical residential mortgages.

The majority of buy-to-let mortgages are provided on an interest-only basis.

Interest-only mortgages mean that you only pay the interest on the loan each month of the mortgage term and none of the capital.

This sounds great in the short term because you’re minimising your monthly outgoings, but you need to have a solid plan in place beforehand to either pay off the entire loan or refinance at the end of your mortgage term.

Deposits for a Buy-to-Let Mortgage

First off, it is more expensive for landlords to get a mortgage because you’ll need a much bigger deposit than buying a residential property for yourself.

For example, residential buyers get a mortgage with as little as a 5% deposit (95% mortgage), whereas the minimum deposit for a buy-to-let mortgage is usually between 20 to 40 per cent of the property’s value.

And, like a typical mortgage, the bigger the deposit you put down, the better rates you’ll get.

The best buy-to-let mortgage deals are available to investors with larger deposits of 40% and above.

However, it’s worth doing serious research as business mortgage rates are higher than for private landlords.

Buy to Let Mortgage Providers

There are many options when looking for a buy to let mortgage, most of the big banks including Natwest, Barclays and HSBC plus some other specialist lenders offer buy to let mortgages.

The best way to find a BTL mortgage is by speaking to a mortgage broker that can find you the best and most suitable deals for your particular situation.

Mortgage Interest Tax Relief

In recent years there have been some significant changes to mortgage interest tax relief.

In April 2020, as a landlord, you can no longer deduct any mortgage expenses from rental income to reduce your tax bill. Meaning that interest paid on your mortgage is no longer classed as an expense.

Instead, landlords now receive a tax credit based on 20% of the yearly mortgage interest payments.

These changes basically mean you could pay more tax than you would have before April 2020.

A potential workaround is to set up a business (limited company) that owns your rental properties.

As a business, landlords will be able to continue to declare rental income and deduct the mortgage payments from the business’s profits.

However, you could actually end up worse off because mortgage rates are higher for businesses which could cost more than the tax savings so it’s essential to do some proper research to check which is the better option for your circumstance.

Stamp Duty for Buy-to-Let Properties

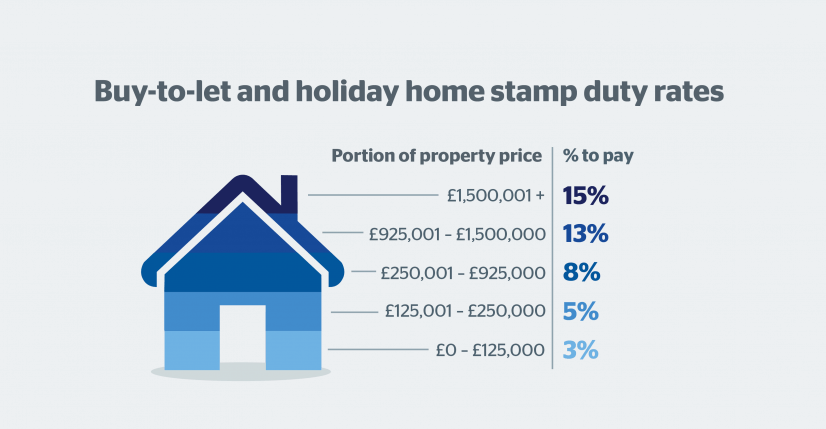

Stamp Duty Land Tax is another important consideration for landlords as you’ll pay a higher rate if you intend to rent out your property – but you can find out how much you should expect to pay here.

Basically, when you buy a second property as a buy to let, you’ll have to pay an extra 3% in stamp duty. This increase in stamp duty also applies when buying a second home or a holiday home.

The exception to this rule is when people who’ve never owned a property buy a buy to let house. Anyone investing in buy-to-let property as first-time buyers who will pay the standard rates.

Conclusion

In all, there are many things to consider when getting a buy-to-let mortgage, and you’ll have to do a lot of research and weigh up what will work best for you. But as property prices look to continue to rise, property remains an exciting investment opportunity.

Ready to Get Started?

If you’d like to find out more, speak to our team today.

To maximise investor returns, we select investment properties in the most profitable UK cities, including Manchester, Birmingham, and Liverpool.