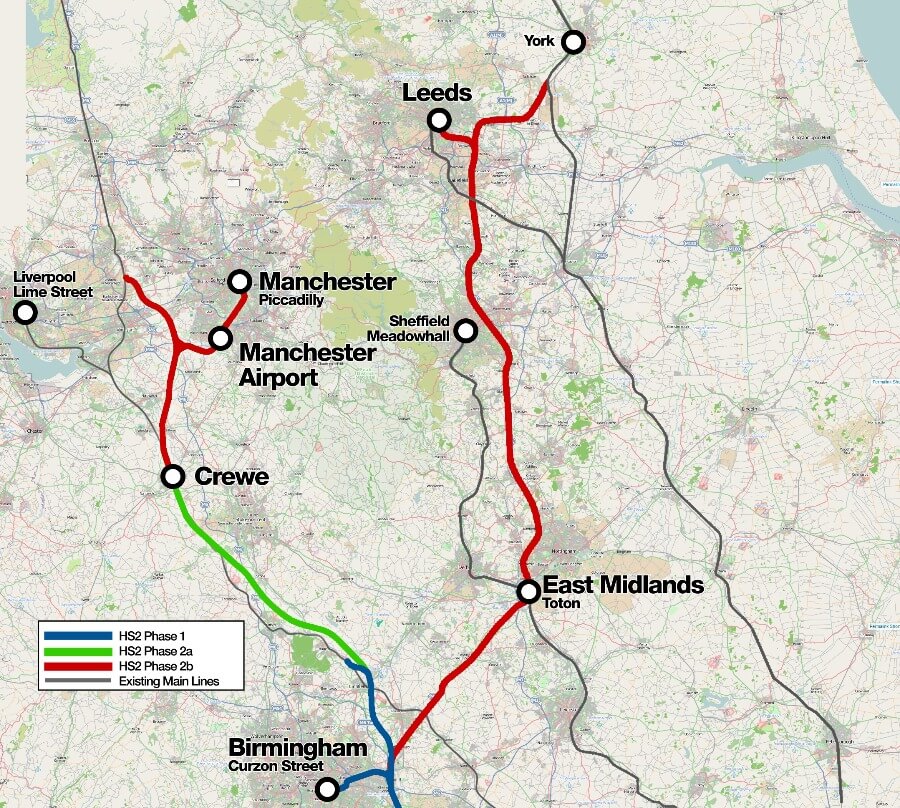

HS2 promises a lot of things for the UK. At face value, it offers a high-speed rail link between London and major cities in the Midlands and North of England – cutting journey times and increasing capacity.

But what it really represents is much more than that: it’s a promise of new jobs and economic growth outside of London.

And it’s the latter offerings that we’re looking to address. Namely, how will HS2 impact UK property investment?

First, let’s look at the current state-of-play.

Even those with a casual interest in property know that house prices have and are continuing to rise.

According to the Halifax House Price Index, in 2021, the North West saw the biggest jump in house prices in England, with the region’s annual rise reaching 11.8%.

And while Halifax Managing director Russell Galley predicted a slower growth for 2022, Savills have forecast that Northwest house prices will rise 18.8% by 2026 – London, by comparison, is only expected to increase by 5.6%.

Now, when we look at how HS2 could affect house prices, it can only be viewed as an exciting opportunity for investors.

HS2 will generate more local jobs, with over 17,000 direct jobs expected to be created for the construction of the Crewe to Manchester leg alone. Of course, that’s only the direct roles. It was predicted by HS2 LTD (in The Strategic Case for HS2) that their new stations could support up to 100,000 jobs – a major boost for the property market.

Inevitably, as more roles and opportunities are made across the country through HS2, it will mean more people will move to be nearer HS2 Hubs and look to buy property – driving house prices up.

The key element in this is the better located a property is, the more it will appeal to renters and buyers.

In Birmingham, HS2 is viewed as a key contributor to its rising population, which has driven the demand for rental properties and, therefore, driven rental costs up. The massive investment has drawn in workers to the city and canny investors.

The better accessibility across the country can only mean one thing for investors in conveniently located properties – a strong return on investment. And seeing as property prices are continuing to rise in the North West, the sooner you invest in properties set to be near HS2, the better the return on investment you’ll see as the HS2 advances.

To summarise, the exciting HS2 project looks sure to boost an area’s appeal – drawing in workers and investors alike. It looks very likely that this will cause property costs to rise, and it would be of little surprise to see property investments in the North.